Lawmakers abandon proposal to nix adoption tax credit

Republican lawmakers have abandoned plans to repeal the adoption tax credit following the outcry from numerous conservative and pro-life groups.

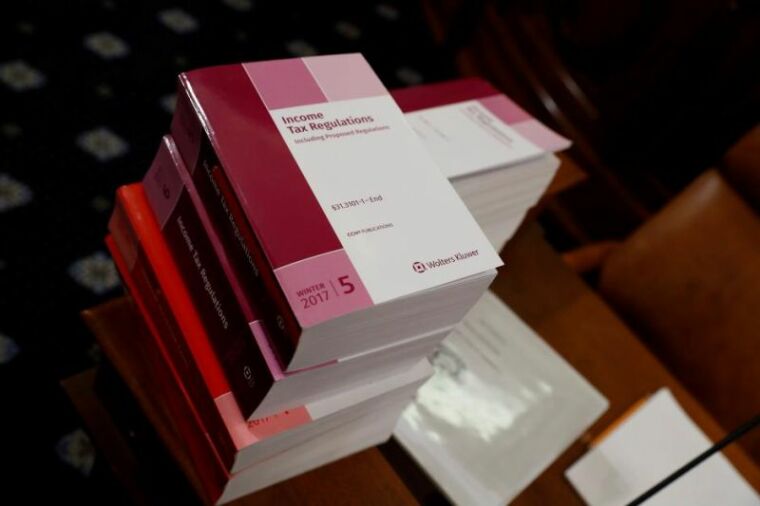

The proposed tax reform legislation unveiled by Republican lawmakers last week had included a provision to eliminate the adoption tax credit, which reduces the tax bill for adoptive families and allows them to claim $13,750 in adoption expenses.

However, the proposal had drawn criticism from pro-life advocates and Christian leaders, prompting the lawmakers to release an amendment to save the tax credit for adoptive families.

On Thursday, the House Ways and Means Committee voted 24–16 to preserve the tax credit, much to the relief of adoption advocates such as Southern Baptist spokesman and adoptive dad Russell Moore.

"This is not just some other policy, but a lifeline to children in need and to families trying to welcome them into their homes," Moore, the president of the Ethics and Religious Liberty Commission (ERLC), told Christianity Today.

"It is in the national interest to see to it that vulnerable children are protected, not exiled in a system. I'm glad to see that interest upheld rather than torpedoed in the Senate's proposal," he added.

Rep. Trent Franks, co-chair of the Congressional Coalition on Adoption, said that he was "deeply grateful" that his fellow Republican lawmakers had decided to preserve the adoption tax credit.

"The Republican Party has been and always will be the party of life. The adoption tax credit has enormous symbolic, practical, and humanitarian meaning and purpose," he said.

Adoption advocates have argued that supporting the adoption tax credit can be considered fiscally conservative, as some studies have indicated that the government saves between $65,000 and $127,000 for each child who is adopted rather than placed in long-term foster care.

Other studies have found that adopted children have a better chance of succeeding as adults compared to foster care children.

U.S. Representative Chris Smith (R-New Jersey), who first introduced the adoption credit in 1990, stressed the importance of keeping the credit, noting that 74,000 people benefited from it last year alone. He contended that the adoption credit is aimed at making adoption more practical for the average family.

"It is targeted to people who might find it very hard without the credit to put together the economic piece to go ahead with their plans to adopt a child. We need to encourage adoption, it is a loving option to get kids in homes," he added.

On Thursday, Senate Republicans released their version of the tax proposal which included the adoption tax credit. Sen. Rob Portman (R-Ohio), who sits on the Finance Committee, noted that the overall framework of the two bills will be very similar, but there are some differences.

According to CBN News, the Senate's version of the tax bill could potentially delay the lowering of the corporate tax rate from 35 percent to 20 percent to ease the impact of the national deficit.

The House and Senate tax bills will have to be first reconciled before they can advance to the White House for President Donald Trump's signature.

Christians don't have to affirm transgenderism, but they can’t express that view at work: tribunal

Christians don't have to affirm transgenderism, but they can’t express that view at work: tribunal Archaeology discovery: Medieval Christian prayer beads found on Holy Island

Archaeology discovery: Medieval Christian prayer beads found on Holy Island Presbyterian Church in America votes to leave National Association of Evangelicals

Presbyterian Church in America votes to leave National Association of Evangelicals Over 50 killed in 'vile and satanic' attack at Nigerian church on Pentecost Sunday

Over 50 killed in 'vile and satanic' attack at Nigerian church on Pentecost Sunday Ukrainian Orthodox Church severs ties with Moscow over Patriarch Kirill's support for Putin's war

Ukrainian Orthodox Church severs ties with Moscow over Patriarch Kirill's support for Putin's war Islamic State kills 20 Nigerian Christians as revenge for US airstrike

Islamic State kills 20 Nigerian Christians as revenge for US airstrike Man who served 33 years in prison for murder leads inmates to Christ

Man who served 33 years in prison for murder leads inmates to Christ

Nigerian student beaten to death, body burned over ‘blasphemous’ WhatsApp message

Nigerian student beaten to death, body burned over ‘blasphemous’ WhatsApp message 'A new low': World reacts after Hong Kong arrests 90-year-old Cardinal Joseph Zen

'A new low': World reacts after Hong Kong arrests 90-year-old Cardinal Joseph Zen Iran sentences Christian man to 10 years in prison for hosting house church worship gathering

Iran sentences Christian man to 10 years in prison for hosting house church worship gathering French Guyana: Pastor shot dead, church set on fire after meeting delegation of Evangelicals

French Guyana: Pastor shot dead, church set on fire after meeting delegation of Evangelicals ‘Talking Jesus’ report finds only 6% of UK adults identify as practicing Christians

‘Talking Jesus’ report finds only 6% of UK adults identify as practicing Christians Mission Eurasia ministry center blown up in Ukraine, hundreds of Bibles destroyed: 'God will provide'

Mission Eurasia ministry center blown up in Ukraine, hundreds of Bibles destroyed: 'God will provide' Church holds service for first time after ISIS desecrated it 8 years ago

Church holds service for first time after ISIS desecrated it 8 years ago Burger King apologizes for 'offensive campaign' using Jesus' words at the Last Supper

Burger King apologizes for 'offensive campaign' using Jesus' words at the Last Supper Uganda: Muslims abduct teacher, burn him inside mosque for praying in Christ’s name

Uganda: Muslims abduct teacher, burn him inside mosque for praying in Christ’s name