Senate parliamentarian drops repeal of Johnson Amendment from GOP tax bill

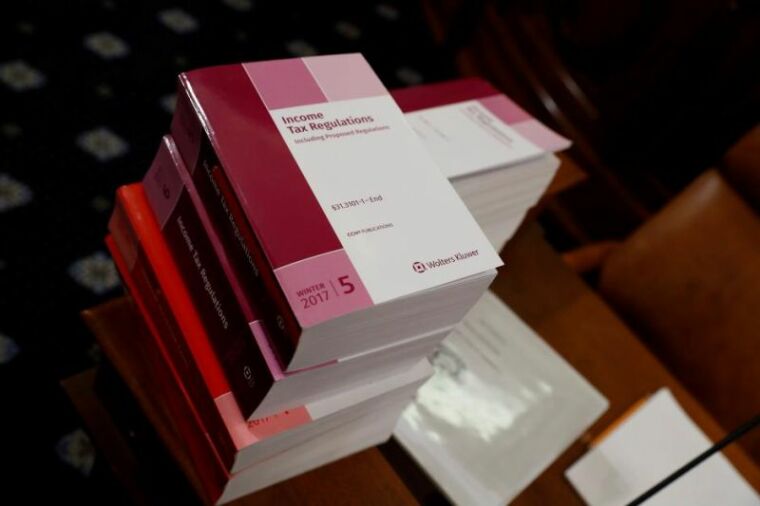

A Senate parliamentarian has blocked a provision that would have repealed the Johnson Amendment from the tax bill on the grounds that it violated Senate rules.

Sen. Ron Wyden (D-Ore.), the senior Democrat on the Senate Finance Committee, announced on Thursday night that the repeal of the Johnson Amendment was removed because the provision did not meet Senate rules that require elements of the tax bill to have something to do with the budget.

The repeal would have temporarily allowed churches and other nonprofits to endorse political candidates without losing their tax-exempt status.

The provision was originally included in the tax reform bill that was passed by the House last month, although it was not in the Senate bill. Wyden said that the repeal was removed during the reconciliation process with the Senate version.

"I will continue to fight all attempts to eliminate this critical provision that keeps the sanctity of our religious institutions intact, prevents the flow of dark money in politics, and keeps taxpayer dollars from advancing special interest biddings," Wyden said in a statement, as reported by The Wall Street Journal.

Under the Senate's Byrd Rule, reconciliation bills cannot contain "extraneous" provisions that do not primarily deal with fiscal policy.

Supporters of the provision argued that the Johnson Amendment infringes on free speech rights of pastors.

Sen. James Lankford (R-Okla.) expressed disappointment that the repeal will not be included in the tax bill.

"The federal government and the IRS should never have the ability, through our tax code, to limit free speech; this tax reform bill was an appropriate place to address this historic tax problem," he said in a statement, as reported by The Hill.

"Nonprofits are allowed to lobby Congress or their local elected officials, but the ambiguity of the current tax code keeps non-profits in constant fear that they might have crossed a line that no other organization has to consider," he added.

The Johnson Amendment, named for then-Sen. Lyndon Johnson (D-Texas), has been part of the tax code since 1954, but the IRS rarely uses it against churches even when pastors blatantly violate the rule.

The regulation does not prevent churches from participating in voter registration drives or pastors from speaking about political issues.

During the 2016 presidential campaign, President Donald Trump had promised to repeal the measure, saying it would "give our churches their voice back."

A LifeWay Research survey conducted during the campaign period has found that 73 percent of Americans with evangelical beliefs want pastors to abstain from endorsing candidates, and about 65 percent believe that churches overall should abstain. However, only 33 percent of evangelicals say they want churches to be punished if they do endorse candidates.

Christians don't have to affirm transgenderism, but they can’t express that view at work: tribunal

Christians don't have to affirm transgenderism, but they can’t express that view at work: tribunal Archaeology discovery: Medieval Christian prayer beads found on Holy Island

Archaeology discovery: Medieval Christian prayer beads found on Holy Island Presbyterian Church in America votes to leave National Association of Evangelicals

Presbyterian Church in America votes to leave National Association of Evangelicals Over 50 killed in 'vile and satanic' attack at Nigerian church on Pentecost Sunday

Over 50 killed in 'vile and satanic' attack at Nigerian church on Pentecost Sunday Ukrainian Orthodox Church severs ties with Moscow over Patriarch Kirill's support for Putin's war

Ukrainian Orthodox Church severs ties with Moscow over Patriarch Kirill's support for Putin's war Islamic State kills 20 Nigerian Christians as revenge for US airstrike

Islamic State kills 20 Nigerian Christians as revenge for US airstrike Man who served 33 years in prison for murder leads inmates to Christ

Man who served 33 years in prison for murder leads inmates to Christ

Nigerian student beaten to death, body burned over ‘blasphemous’ WhatsApp message

Nigerian student beaten to death, body burned over ‘blasphemous’ WhatsApp message 'A new low': World reacts after Hong Kong arrests 90-year-old Cardinal Joseph Zen

'A new low': World reacts after Hong Kong arrests 90-year-old Cardinal Joseph Zen Iran sentences Christian man to 10 years in prison for hosting house church worship gathering

Iran sentences Christian man to 10 years in prison for hosting house church worship gathering French Guyana: Pastor shot dead, church set on fire after meeting delegation of Evangelicals

French Guyana: Pastor shot dead, church set on fire after meeting delegation of Evangelicals ‘Talking Jesus’ report finds only 6% of UK adults identify as practicing Christians

‘Talking Jesus’ report finds only 6% of UK adults identify as practicing Christians Mission Eurasia ministry center blown up in Ukraine, hundreds of Bibles destroyed: 'God will provide'

Mission Eurasia ministry center blown up in Ukraine, hundreds of Bibles destroyed: 'God will provide' Church holds service for first time after ISIS desecrated it 8 years ago

Church holds service for first time after ISIS desecrated it 8 years ago Burger King apologizes for 'offensive campaign' using Jesus' words at the Last Supper

Burger King apologizes for 'offensive campaign' using Jesus' words at the Last Supper Uganda: Muslims abduct teacher, burn him inside mosque for praying in Christ’s name

Uganda: Muslims abduct teacher, burn him inside mosque for praying in Christ’s name